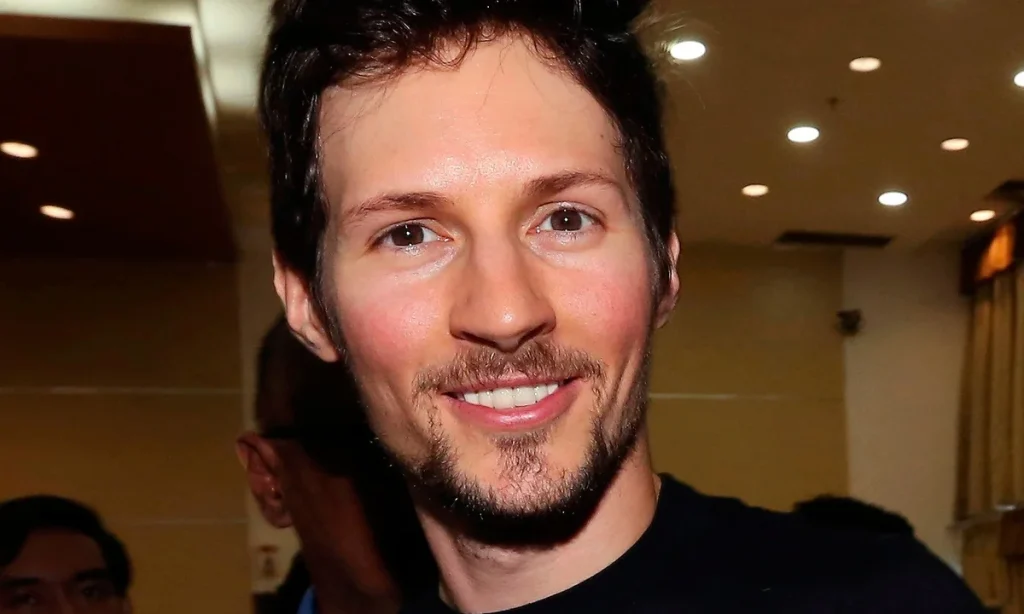

Toncoin OI Surges 67% as Durov Leaves France

Toncoin (TON) Open Interest (OI) surged 67% in the past 24 hours, following reports that Telegram founder Pavel Durov has left France, where he had been required to stay since his August 2024 arrest. According to CoinGlass data, Toncoin OI hit $169 million on March 15, marking its highest level since Feb. 1, when it […]

Toncoin OI Surges 67% as Durov Leaves France Read More »

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin