Midas is set to revolutionize the intersection of cryptocurrency and traditional finance with the introduction of its stUSD token, a stablecoin uniquely backed by U.S. Treasuries. This innovative financial product is poised to debut on prominent decentralized finance (DeFi) platforms such as MakerDAO, Uniswap, and Aave, marking a significant stride in the fusion of crypto and traditional finance sectors.

Midas: Bridging Crypto and TradFi The Midas stablecoin project, as detailed in a presentation deck obtained by CoinDesk, plans to purchase U.S. Treasuries through asset management giant BlackRock. The project will leverage Circle Internet Financial’s USDC stablecoin as a gateway into the DeFi ecosystem. Additionally, Midas has partnered with Fireblocks for custody technology and Coinfirm for blockchain analytics, ensuring a robust and secure framework for its operations.

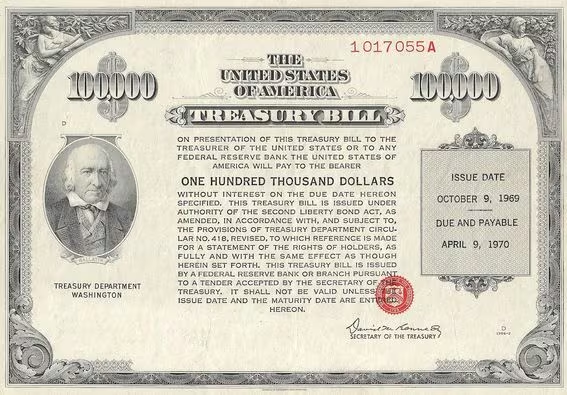

The Rationale Behind Tokenizing Treasuries With yields from traditional finance (TradFi) assets like U.S. Treasuries currently surpassing those from standard DeFi products, Midas aims to tokenize these TradFi assets, making them accessible within the DeFi space. This approach aligns with the growing interest in tokenized real-world assets, a sector gaining traction among TradFi firms eager to integrate key market components onto blockchain infrastructure for enhanced efficiency.

Midas’ Strategic Position in the Market The upcoming launch of the Midas stUSD stablecoin, scheduled for integration with DeFi platforms this quarter ahead of a retail rollout next year, positions it alongside other yield-bearing stablecoins such as Mountain Protocol and Ondo Finance. It’s important to note that this new Midas stUSD project is distinct from the now-defunct DeFi investment firm Midas.

Leadership and Legal Framework The Midas team is led by notable figures including Fabrice Grinda, founder and executive chairman of Global Technology Acquisition Corp. (GTAC), and Dennis Dinkelmeyer, vice president of GTAC. The stUSD token is fully backed by U.S. Treasuries and issued as a debt security under German law, ensuring a solid legal foundation.

Midas emphasizes compliance with European Securities Regulation and Anti-Money Laundering law, with funds held in segregated accounts managed by BlackRock. The transfer of the stUSD token equates to the transfer of legal rights to the underlying U.S. Treasuries, offering a unique blend of security and innovation.

Midas’ introduction of the stUSD stablecoin represents a significant advancement in the fusion of cryptocurrency and traditional finance. By backing a stablecoin with U.S. Treasuries and ensuring compliance with stringent regulations, Midas is setting a new standard for stability and innovation in the DeFi space.