Bitcoin (BTC) mining difficulty has reached a new all-time high of 95.67 terahashes (T). Marking a 3.9% increase as of Tuesday, according to data from Glassnode. This milestone underscores the growing challenges for miners as the difficulty of mining new blocks on the Bitcoin network continues to rise.

Rising Difficulty in 2024

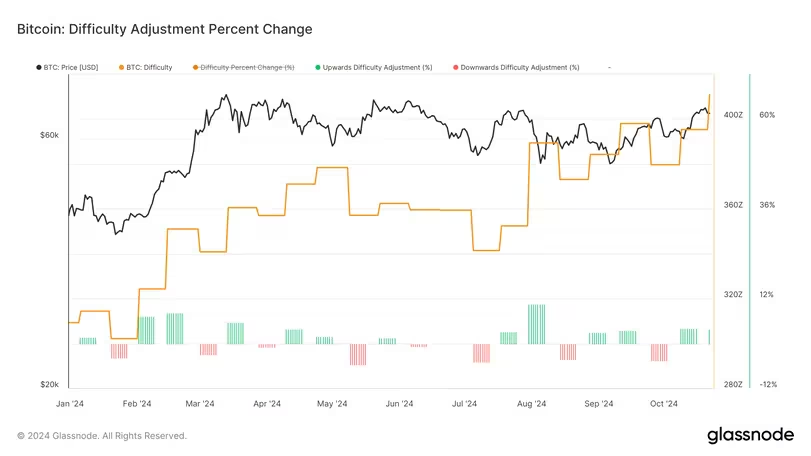

The Bitcoin network automatically adjusts its mining difficulty every 2,016 blocks—roughly every two weeks. To ensure that blocks are mined at an average interval of 10 minutes. So far, in 2024, there have been 22 difficulty adjustments, with 13 of them being positive. Year-to-date, Bitcoin’s difficulty has surged from 72T to 95.67T, representing a 27% increase.

This rise in difficulty has coincided with Bitcoin’s hashrate—the total computational power securing the network—hitting record highs of over 700 exahashes per second (EH/s). As mining difficulty increases, miners need more powerful equipment to remain competitive. leading to higher operational costs.

Miner Consolidation and Revenue Pressure

As the difficulty rises, many smaller and unprofitable miners have struggled to keep up. Since the April 2024 halving, some miners, especially smaller private operations, have been forced to either unplug their machines or sell their Bitcoin holdings to cover costs. This has led to a 15% drop in the network’s hashrate at various points in the year as miners exited the industry.

Glassnode data shows that from November 2023 to July 2024, over 30,000 BTC left miner wallets. Marking one of the longest periods of miner distribution on record. However, since July, miner balances have stabilized and even shown signs of accumulation, indicating that the remaining miners are better equipped to handle the current environment.

The mining industry is also seeing increasing consolidation, with public mining companies now controlling nearly 30% of the network. These larger, more efficient miners are better positioned to handle the rising difficulty and operational costs, potentially reshaping the mining landscape.

Bitcoin Mining Revenue and Bull Runs

Bitcoin’s mining revenue is another critical indicator for the industry. On a 7-day moving average (7-DMA), total dollar revenue for miners has surpassed $35 million, up from a September low of around $25 million.

However, since the April halving, mining revenue has remained below the 365-day simple moving average (SMA), currently priced at $40 million. Historically, when total miner revenue climbs above this 365-SMA level, it has coincided with Bitcoin bull runs. As mining revenue continues to rise, some analysts suggest that we could be on the verge of another bull market for Bitcoin.