The United States is grappling with an unprecedented debt crisis, with national debt reaching a staggering $33 trillion, marking a historical high. This comes amid rising interest rates, adding more strain to the nation’s economy. The US government has been accruing approximately $1 trillion in debt monthly since the debt ceiling crisis, highlighting the escalating financial predicament facing the country.

A New Milestone in National Debt

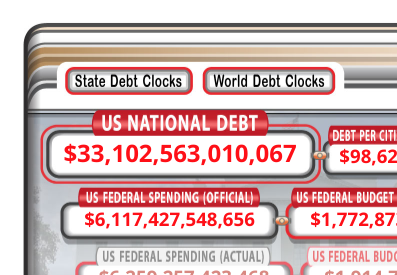

The US has reached a new, unwelcome milestone, with its gross national debt surpassing $33 trillion, as reported by The Kobeissi Letter on September 19. Maya MacGuineas, President of the Committee for a Responsible Federal Budget, expressed concern over this alarming development, emphasizing the lack of pride in reaching such a milestone.

The Removal of the Debt Ceiling

The debt ceiling, which had acted as a cap to government borrowing, was effectively removed when President Joe Biden approved a bill on June 3. This removal allows for the accumulation of more debt and is set to remain uncapped until January 2025. Over the past five years, the US has added $11.5 trillion in debt, with interest soon becoming the government’s biggest expense.

Comparisons and Projections

To put things into perspective, the entire cryptocurrency market is valued at $1.1 trillion, a fraction of the US national debt. Projections suggest that, if the current pace continues, the US could see its national debt exceed $50 trillion before the decade ends. The US federal debt to GDP ratio stands at 122.4%, a concerning figure reflecting the country’s economic health.

Differing Perspectives on the Crisis

Treasury Secretary Janet Yellen appears relatively unconcerned, focusing on net interest as a share of GDP as a key metric to judge the fiscal course. However, others, like Mark Spitznagel, founder of hedge fund Universa Investments, warn that the world is witnessing the “greatest credit bubble in human history.” Spitznagel emphasized the experimental nature of the current level of total debt and leverage in the system and the inevitable bursting of the credit bubble.

Skyrocketing Interest Payments

Government expenditures in interest payments have surged to nearly $1 trillion, with the last figures included at the end of Q2, according to the St. Louis Fed. Over the past three years, these interest payments have almost doubled. Personal interest payments also reached a record $506 billion in July, an 80% increase since 2021, attributed to rising interest rates currently at 5.5%.

The soaring national debt of the United States, coupled with rising interest rates, paints a grim picture of the country’s economic future. The removal of the debt ceiling and the subsequent accumulation of debt raise questions about the sustainability of such financial practices. While some officials remain seemingly unphased by the escalating figures, experts warn of the impending burst of the credit bubble, underscoring the need for prudent financial management and strategies to navigate the unfolding economic landscape.