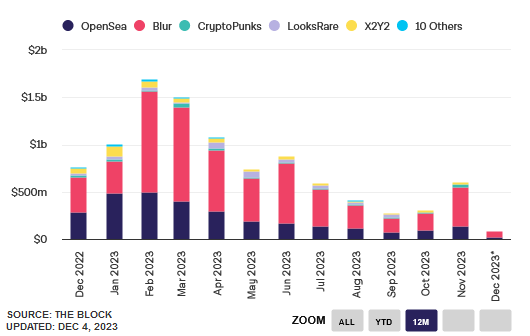

The digital horizon is being reshaped as the non-fungible token (NFT) marketplace witnesses an unprecedented surge in trading volume, largely dominated by Blur. This development is not just a monthly fluctuation but a sign of a tectonic shift in the NFT landscape, with Blur seizing nearly 80% of the market’s activity. The implications of this shift are wide-reaching, affecting traders, creators, and the underlying technology itself.

November’s trading data painted a striking picture of this evolution. Ethereum-based NFT trades, which serve as a bellwether for the industry, doubled from $306 million in October to an astonishing $605 million. As the calendar turned to December, the momentum hardly skipped a beat, with trading volumes rapidly approaching $90 million within the first few days. Blur’s platform, a relative newcomer to the scene, was at the epicenter of this whirlwind, accounting for nearly $70 million of the total volume.

The emergence of Blur has rattled the once-stable hegemony of platforms like OpenSea, which has seen its hold on the market shrink to about 17%. The pivot towards Blur is a clear indicator of the market’s evolving preferences, with users gravitating towards more innovative and trader-centric platforms. Blur’s ascension is particularly noteworthy because it signals a preference for platforms that are aligning with the traders’ needs for speed, efficiency, and reduced transaction costs.

The NFT marketplace’s evolution is also characterized by diversification. Solana-based NFT marketplaces, for instance, are experiencing a renaissance of their own. The volumes on these platforms surged throughout November, peaking at levels not seen since the previous spring. This diversification is crucial because it underscores the resilience and adaptability of the NFT market, hinting at a future where multiple blockchains support a vibrant ecosystem of digital assets.

The rise of Blur and the broader expansion of the NFT market can be attributed to several factors. One is the maturation of blockchain technology, which has enabled platforms to provide more stable and efficient services. Another is the growing recognition of NFTs as a legitimate asset class among mainstream investors. As traditional financial institutions begin to explore the tokenization of assets, the infrastructure provided by platforms like Blur becomes increasingly important.

The implications of Blur’s market dominance for crypto asset security are profound. Traditional security measures may no longer suffice in a market that is rapidly innovating and expanding. The rise of quantum computing, for instance, presents new challenges and opportunities for crypto asset security. As IBM and other tech giants progress in quantum computing, the NFT market must be prepared to adapt its security measures to protect against potential quantum-powered threats.

The trajectory of the NFT economy is being closely monitored by investors and traders alike. As the market continues to mature and expand, the need for robust security solutions will become ever more pressing. Platforms like Blur must be at the forefront of this charge, ensuring that as the market grows, it remains secure and trustworthy.

In conclusion, the NFT market, led by platforms like Blur, is on the brink of a new era. The market’s growth is not just about the volume of trades but also about the sophistication and security of the infrastructure that underpins it. As the market continues to evolve, it will be the responsibility of platforms, traders, and regulators to ensure that it remains a safe and vibrant space for innovation and investment. The future of NFTs is bright, and with the right approach, the market can continue to thrive in the face of new challenges and opportunities.