Embracing Complexity: Crypto Derivatives Market Forecast for Robust Growth

2024 marks a pivotal year as investors diversify into sophisticated financial instruments. The crypto derivatives market is poised for exponential growth, with exotic options, structured products, and collateralized debt obligations (CDOs) becoming increasingly sought-after.

Historically, the crypto sector has mirrored its traditional counterpart, progressing from the initial coin offering (ICO) frenzy in 2017 to the decentralized finance (DeFi) and yield farming boom in 2021. Now, with the onset of a new bull cycle, the industry is gearing up for the introduction of advanced financial products on the blockchain, akin to those found in traditional finance.

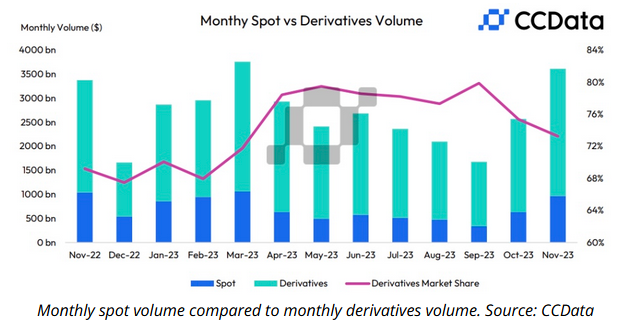

The rise in crypto derivatives trading has been notable, with November witnessing a 37.3% spike in volumes to $2.58 trillion — the highest since March, despite a slight decrease in their market share. Open interest in crypto options has also seen unprecedented highs, indicating a robust and recovering market.

As the derivatives market recuperates, more intricate products are making an entrance. These include decentralized perpetual futures trading and novel risk management tools, setting the stage for a wave of innovation in the coming year. The crypto space is expected to expand with the introduction of exotic options and structured products similar to those in the traditional market.

While complex derivative products currently represent a minuscule portion of the crypto market, the potential for growth is substantial. On-chain structured products, for instance, account for only 0.21% of crypto’s total market cap. This opens up opportunities for significant expansion, particularly as institutional interest in digital assets continues to escalate.

Three factors are driving the surge in sophisticated derivative products:

- Increased institutional engagement in digital assets is spurring demand and fostering innovation within the crypto derivatives market, projected to mirror the traditional market’s extensive reach.

- With the fading of crypto winter, investors are shifting their focus from high-risk yield farming to derivatives and structured products, which offer high returns with added downside protection.

- The quest for capital preservation has intensified post-2022’s market upheavals. Investors now prioritize financial vehicles that offer some degree of capital protection, like structured products that can provide guaranteed returns while safeguarding the principal investment.

As crypto matures, the quest for predictable returns and diversified portfolios will catalyze the adoption of these complex financial vehicles, granting them a renewed spotlight. Innovations in the structured product space and the introduction of new derivatives projects are expected to propel the market forward, defining the current bull run and cementing 2024 as the year of sophisticated crypto investment strategies.