Tether’s (USDT) inflow into exchanges has recently surged to notable heights. This phenomenon could be an encouraging omen for Bitcoin, painting a positive outlook for the digital currency sector.

Unpacking the Data:

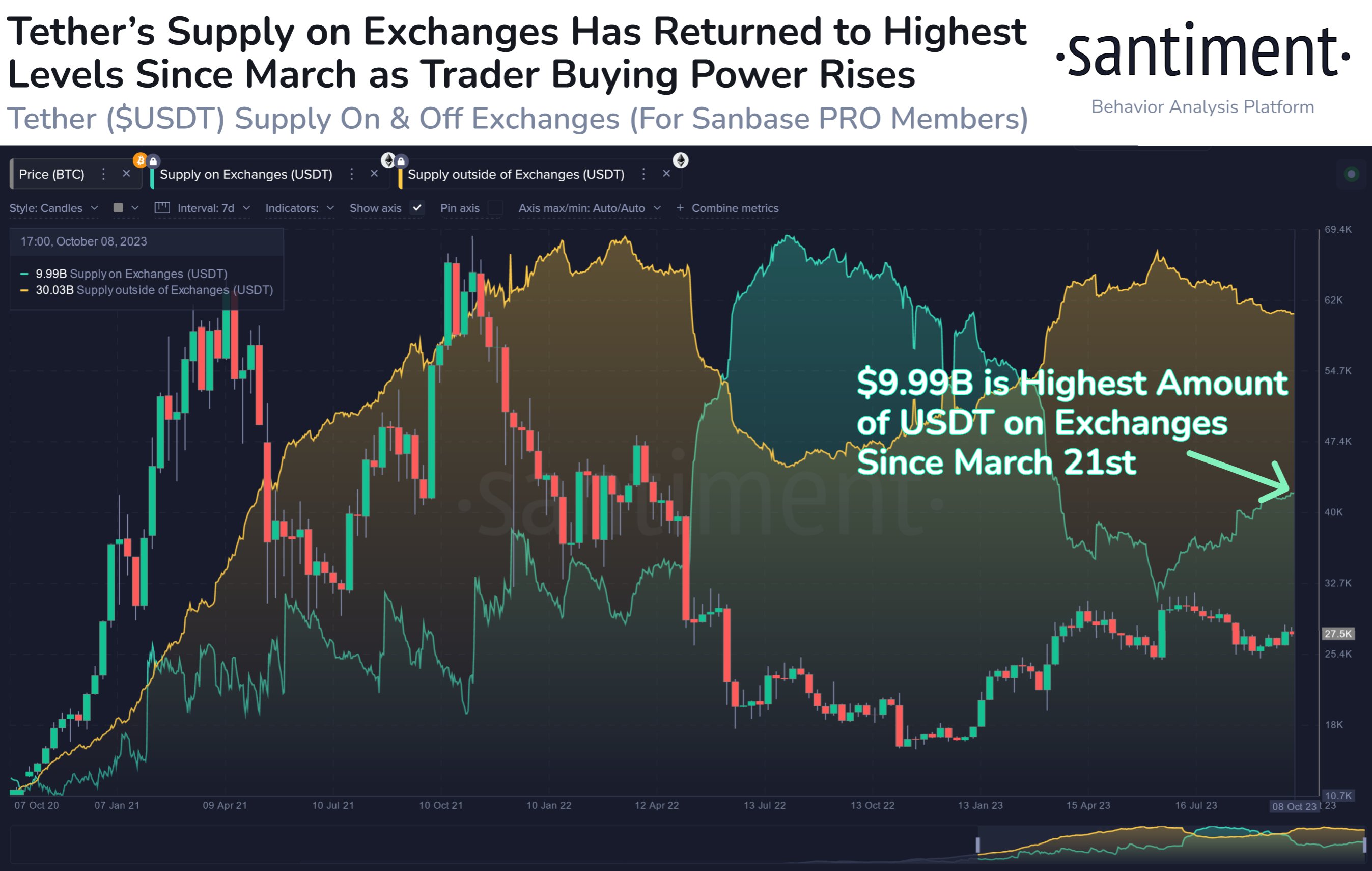

Santiment, a reputable on-chain analytics firm, has provided compelling data revealing that a staggering $9.99 billion in USDT is currently held in exchanges. To gauge the importance of this figure, the “supply on exchanges” metric comes into play. Essentially, this metric gives a comprehensive view of the volume of a specific cryptocurrency harbored in centralized exchange wallets.

For most cryptocurrencies, interpreting this metric usually orbits around potential selling pressure. Taking Bitcoin as an example, a surge in its supply on exchanges might be perceived as an uptick in selling intent, hinting at a possible bearish market trajectory. Related Reading: Why Hitting $29,700 Could Be a Significant Milestone for Bitcoin

However, the spotlight here is on Tether. USDT stands out as a paramount stablecoin, maintaining a consistent value peg to the US Dollar.

The chart below delineates the Tether supply trend on exchanges over recent times:

Looks like the value of the metric has been going up in recent days | Source: Santiment on X

Recent data points to a steady ascent in Tether’s exchange supply. Ordinarily, investors pivot to stablecoins like USDT to shield their capital from the inherent volatility of the cryptocurrency ecosystem. Yet, it’s crucial to note that many park their assets in stablecoins as an interim safeguard, often with an eye to re-enter the unpredictable crypto market.

As these investors recalibrate and transition back to volatile digital assets such as Bitcoin, they routinely exchange their USDT holdings. The augmentation of USDT’s supply in exchanges might be indicative of a collective sentiment gearing up for this transition, signaling potential bullish momentum for Bitcoin and akin cryptocurrencies. Recent trends underscore that the indicator has been on an upward trajectory. As highlighted by Santiment, “The nearly $10 billion Tether available in exchanges represents the apex of purchasing potential for the dominant stablecoin in the span of the past seven months.”

Yet, it’s paramount to remain cognizant that this burgeoning Tether supply in exchanges merely signifies the potential purchasing prowess at hand. Bitcoin’s bullish momentum hinges on whether this potential is channeled towards its acquisition.

BTC Price

Bitcoin has exhibited a minor retreat over recent days, settling around the $27,600 benchmark.

BTC has recovered a bit from its lows from yesterday | Source: BTCUSD on TradingView