Crypto Evolution or Regulatory Clarity? SEC’s Approach to NFTs Sparks Fresh Dialogue on Digital Assets –

BREAKING: GARY GENSLER CONFIRMS THAT THE PURCHASE OF A @Pokemon CARD DOES NOT CONSTITUTE A SECURITY TRANSACTION, BUT STUMBLES WHEN ASKED ABOUT THE PURCHASE OF A TOKENIZED @Pokemon CARD pic.twitter.com/KLJZf4o1yv

— DEGEN NEWS (@DegenerateNews) September 27, 2023

The intersection of the digital assets economy and the steadfast framework of federal securities laws has, predictably, given rise to passionate debates. Some see the Securities and Exchange Commission’s (SEC) stance on digital assets as a play of authority, dubbing it an overextension of jurisdiction or even regulation by enforcement. Others view it as a necessary step in legitimizing the burgeoning crypto landscape.

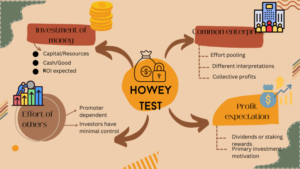

The SEC, for its part, upholds its viewpoint with consistency and coherence. They argue that their stance is not newly minted for the digital age but rather a continuation of their tried and tested approach to overseeing markets, ensuring they remain fair and free from manipulation. They point to landmark cases like SEC v. W.J. Howey and Reeves v. Ernst & Young as guiding lights in this often-murky realm, indicating they’re simply translating old principles to new paradigms. However, within the SEC, there’s no uniformity of opinion. Two of the five commissioners have vocalized their reservations about the commission’s current trajectory, adding fuel to the spirited dialogue on the regulation of digital assets.

The crypto-community, with its eyes ever on the horizon, has watched the SEC’s evolution from overseeing initial coin offerings (ICOs) to now probing into the world of nonfungible tokens (NFTs). These latest inquisitions have rekindled the regulatory debate. Many question the applicability of federal securities laws to NFTs, given their unique nature and inherent non-fungibility. Is this a case of the SEC stepping beyond its boundaries? Or is it the expected trajectory of an agency tasked with ensuring market integrity?

The rise of NFTs is unarguably one of the most groundbreaking developments in the digital asset space. With the SEC now casting its gaze upon them, it’s clear that these tokens are not just a passing fad but something that regulators deem worthy of attention. This gives rise to a key question: Are NFTs truly outside the purview of the SEC, or do they echo the fundamentals that securities laws were created to oversee? It is essential that both the crypto community and regulatory bodies come together in open dialogue. Only through mutual understanding and collaboration can a middle ground be found, ensuring that innovation thrives while investors are protected.