In a significant move forward within the realm of blockchain technology, PayPal has filed a patent application related to the purchasing and transferring of nonfungible tokens (NFTs). This application, which was made public on September 21, had been filed in March and delineates a methodology for executing transactions with NFTs, both on-chain and off-chain.

The Proposed System

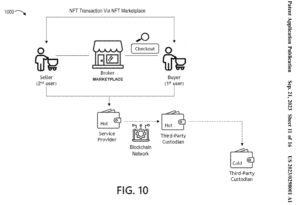

The patent application is currently pending and proposes a system that allows users to buy and sell NFTs via a third-party service provider. While this provider is not specified in the document, Ethereum is explicitly mentioned. The system presents a structure where processing by the service provider would envelop compliance and risk management, allowing users to hold digital wallets. It offers the convenience of not necessitating users to have their own digital wallets, providing alternatives through third-party brokers offering various storage and checkout services.

PayPal aims to unlock the extensive potential of NFTs, extending beyond the realm of digital collectibles. The proposed system can represent a myriad of unique digital data, tracked using a decentralized blockchain ledger. This encompasses digital images, videos, music, collectibles, legal documents, event tickets, deeds to personal property, and other digital art.

Enhanced Customization and Fractionalized Purchases

The architecture of the proposed system allows for extensive customization, enabling fractionalized purchases through governance tokens which can subsequently be traded. Moreover, a decentralized autonomous organization, (DAO) affiliated with the service provider, could serve to bolster NFT liquidity via a specialized platform, while NFTs themselves could generate revenue through royalties.

Optimized for Off-Chain Transactions

Interestingly, the envisaged system is optimized to handle off-chain transactions within an “omnibus wallet,” linked to the service provider and encapsulating both the buyer and seller’s wallets. This means that transactions do not need to be recorded on the blockchain, negating the requirement to broadcast the transaction to the blockchain network or incur the associated gas fees.

Currency Flexibility

The application reveals that the system can operate using any currency. This development comes after PayPal’s introduction of its stablecoin, PayPal USD (PYUSD), in August, a currency built on Ethereum, maintaining a value of $1.00 USD.

Broader Implications

PayPal’s innovative venture into blockchain and NFTs underscores the mainstream acceptance and growing versatility of this technology. The foray into tokenization and the explicit mention of Ethereum signify the recognition of the widespread applicability and potential that blockchain technology holds in not only digitizing art and collectibles but also in representing legal documents, property deeds, and more.

This development is especially noteworthy, considering the company’s recent enhancement of crypto services, enabling U.S. users to sell cryptocurrency through MetaMask wallet. The amalgamation of compliance, risk management, currency flexibility, and the provision of off-chain transactions reflect PayPal’s vision of integrating advanced blockchain solutions to accommodate an evolving digital economy.

Looking Ahead

While the patent is still pending approval, the realization of this project can potentially redefine the transactional dynamics within the blockchain ecosystem, showcasing a blend of customization, security, and user-friendly approaches. PayPal’s ongoing initiatives and advancements in blockchain technology are emblematic of the shift towards a more inclusive and diversified digital asset landscape, poised to shape the future of online transactions and digital ownership.