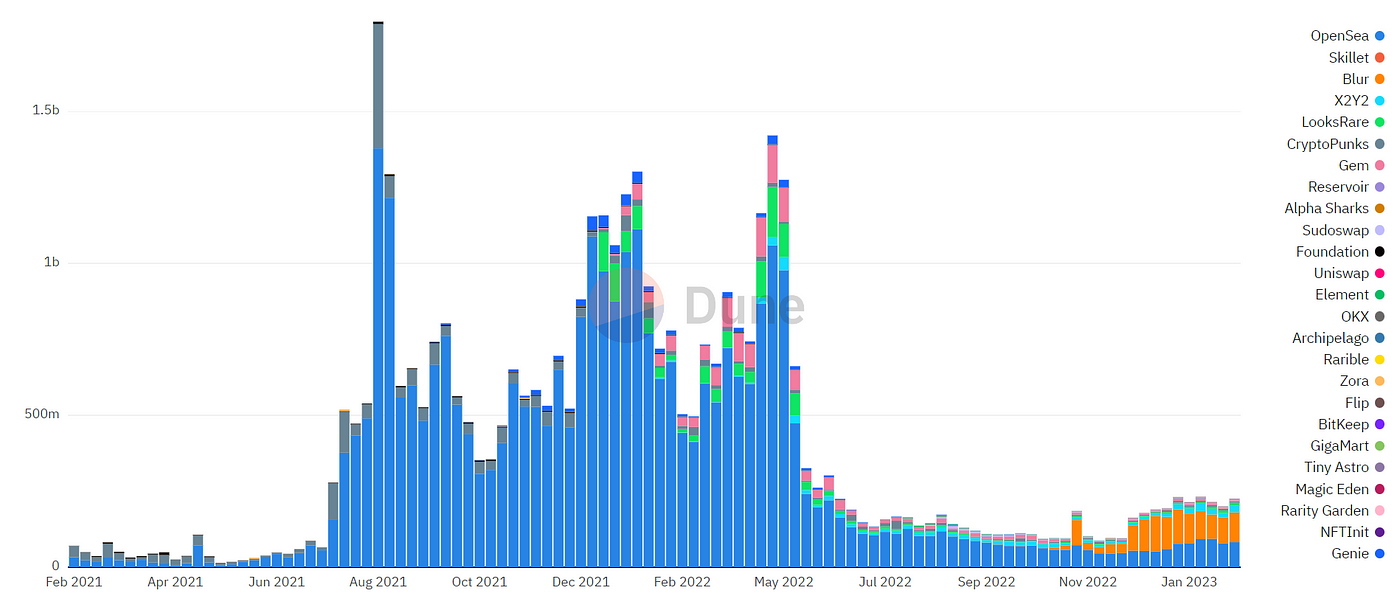

NFT creators are taking a stand against dominant exchanges due to a decline in royalties. Yuga Labs Inc., known for producing Bored Ape Yacht Club and CryptoPunks NFTs, and LSLTTT Holdings Inc, the maker of Pudgy Penguins, are among those either withholding collections or threatening to do so on popular platforms like Blur and OpenSea. The two exchanges reduced royalty rates this year in an effort to revive NFT trading. This move came after a surge in NFT prices and trading activity during the pandemic ultimately led to a significant downturn. September royalties were just $2.4 million compared to a peak of $269 million in January 2022, as reported by Nansen data. Monthly trading volumes plummeted from a record $17 billion during that time, according to Token Terminal figures.

Blur did not respond to requests for comment regarding the fee criticisms. An OpenSea spokesperson noted that royalties can still be a valuable income source and that the platform is focused on building scaling solutions and revenue streams for creators. The effectiveness of boycotts and the creation of alternative marketplaces as strategies for NFT projects remain uncertain, given the dominance of Blur and OpenSea in trading and liquidity.

According to Ally Zach, a research analyst at Messari, users are increasingly resistant to paying royalties and fees, making the long-term viability of the boycott strategy uncertain. For now, Blur and OpenSea will likely continue to face pressure to keep trading costs low, which conflicts with the decentralized ethos that blockchain applications were originally meant to embody, as pointed out by Jake Brukhman, CEO of Coinfund LLC, a web3 venture capital firm.

https://twitter.com/FairlyRC/status/1710773517610807534?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1710773517610807534%7Ctwgr%5E8829978b150c14b0f9e44bb989514a6446fe4b16%7Ctwcon%5Es1_c10&ref_url=https%3A%2F%2Fwww.bloomberg.com%2Fnews%2Farticles%2F2023-10-16%2Fnft-makers-mutiny-against-blur-opensea-over-sinking-royalties

Resistance to Royalties

“Users are increasingly resistant to paying royalties, and fees in general,” said Ally Zach, a research analyst at Messari. “While some collections may try to replicate this boycott strategy, its long-term viability remains uncertain.” For the foreseeable future, Blur and OpenSea will continue to face pressure to keep trading costs down. Their critical role jars with the ethos of decentralization that is supposed to characterize applications of digital ledgers. “We’re kind of failing in a core area of blockchain, because blockchains were meant to democratize these things,” said Jake Brukhman, chief executive officer of web3 venture capital firm Coinfund LLC.

1 thought on “NFT Makers Are Boycotting Low-Fee Exchanges Over Tumbling Royalties”

After looking over a handful of the blog posts on your web page, I really like your technique of writing

a blog. I book-marked it to my bookmark site list and will be checking back in the

near future. Please visit my website as well and tell me

what you think.