Bubblemaps analysts claim they are “highly confident” that the LIBRA (LIBRA) and MELANIA (MELANIA) memecoins were launched by the same team, using insider tactics to manipulate the markets and profit millions.

📌 On-chain data suggests that the same wallets sniped both launches, with over $8.4 million in insider profits recorded.

🚨 LIBRA’s launch has already sparked political controversy, with Argentine President Javier Milei facing impeachment calls after the $107 million meltdown.

Bubblemaps Identifies Key Wallet Behind LIBRA & MELANIA Token Scandals

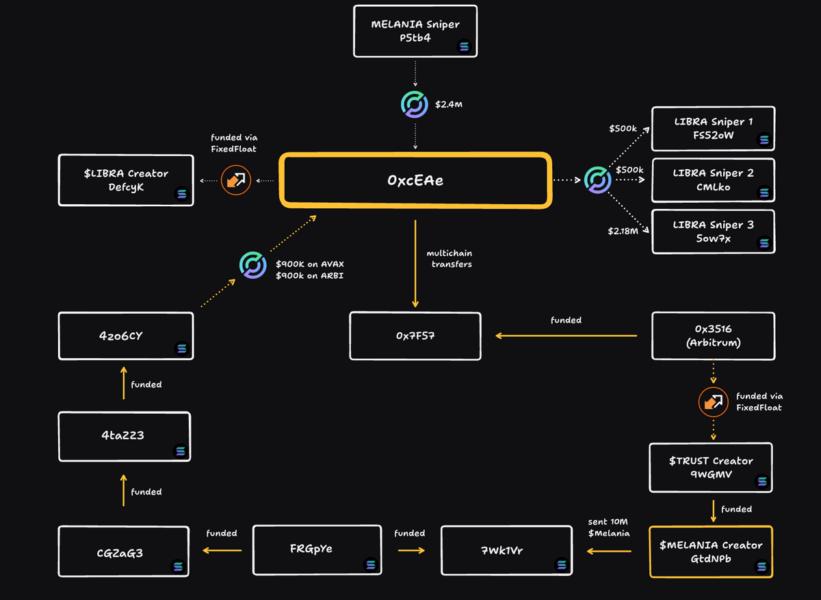

🔹 In a Feb. 17 post, Bubblemaps pointed to a Solana wallet address, “0xcEA”, which they claim was responsible for:

✅ Sniping Melania Trump’s memecoin (MELANIA) launch on Jan. 19, securing $2.4 million in profits.

✅ Immediately transferring these funds to an Avalanche wallet, attempting to obscure transaction history.

✅ Funding the wallet address responsible for launching LIBRA before sniping the token’s launch on Feb. 15, making $6 million in profit.

📌 Both LIBRA and MELANIA were manipulated using identical tactics, including:

1/ How $LIBRA was created by the same team behind MELANIA and other short-lived coins

— Bubblemaps (@bubblemaps) February 17, 2025

Featuring new onchain evidence

A thread with Coffeezilla 🧵 ↓ pic.twitter.com/gNwj97KapF

🔹 Cross-chain transfers through multiple wallets to mask the transaction trail.

🔹 Side addresses funded via Arbitrum and Avalanche wallets before each major pump.

🚨 Bubblemaps concluded that the two memecoins were likely launched by the same team, or by closely connected insiders.

LIBRA & MELANIA: High-Profile “Pump and Dump” Scandals

📊 Bubblemaps also linked the “0xcEA” wallet to other fraudulent token launches, including:

✅ A fake Robinhood (HOOD) token, which peaked at a $120M market cap before crashing to $12.5M.

✅ Other high-profile “pump and dump” schemes, using similar wallet activity patterns.

🚨 LIBRA’s catastrophic collapse wiped out nearly 94% of its value within four hours, after insiders reportedly cashed out over $107 million.

📌 Blockchain intelligence firm Lookonchain found that at least eight wallets linked to the LIBRA team siphoned liquidity, pocketing:

✅ $57.6 million in USD Coin (USDC)

✅ 249,671 Solana (SOL) worth $49.7 million

📌 MELANIA followed a similar trajectory, peaking at $13 billion within hours of its launch on Jan. 19, only to crash 99% to $189 million.

🚨 These events highlight the growing risks of insider trading and fraudulent practices in memecoin markets.

Conclusion: Are Memecoins Becoming Insider Trading Hotspots?

📌 Bubblemaps analysts claim that LIBRA and MELANIA were likely launched by the same insider team.

📌 Key wallet addresses used identical sniping and cash-out tactics, profiting millions.

📌 LIBRA’s $107 million collapse has already triggered calls for political accountability.

📌 Blockchain analysis reveals a pattern of pump-and-dump memecoin schemes.

🚀 As more evidence emerges, will regulators step in to crack down on memecoin manipulation?