Hong Kong is emerging as a beacon of hope for cryptocurrency enthusiasts in East Asia. With the shadow of the 2019 China-wide trading ban looming large, recent advancements in Hong Kong’s crypto landscape are seen as a breath of fresh air, which could potentially reinvigorate the East Asian crypto scene.

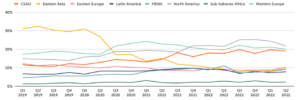

According to a recent report by Chainalysis, from July 2022 to June 2023, East Asia’s share in global crypto value was a mere 8.8%. This places the region in the fifth spot among the most active crypto markets. This is a stark contrast from 2019 when East Asia boasted around 30% of the crypto transaction value. A series of bans on crypto-related activities in China is attributed to this drastic decline.

But hope springs eternal. As Chainalysis notes, the undercurrents in Hong Kong spell optimism. The region, despite its comparably tiny population, has displayed a remarkable appetite for cryptocurrency. Chainalysis’s data suggests that between July 2022 and June 2023, Hong Kong’s crypto inflow was an astounding $64 billion, closely chasing China’s $86.4 billion – a figure even more impressive when considering that Hong Kong’s population is just 0.5% of mainland China.

Merton Lam from Crypto HK, a prominent digital asset trading center in Hong Kong, has remarked on the growing penchant for cryptocurrencies among leading banks, private equity firms, and affluent individuals in the region. Furthermore, several Chinese state-run entities have recently rolled out crypto-centric investment portfolios.

Yet, despite the palpable enthusiasm in Hong Kong, industry experts advise caution. Dave Chapman, from the digital asset platform OSL Digital Securities, opines that Hong Kong’s crypto fervor isn’t necessarily a reflection of mainland China’s stance on digital currencies. He postulates that this might just be China’s way of exploring the crypto domain without adjusting its firm policies on the mainland.

However, Matrixport’s Markus Thielen offers an intriguing perspective, suggesting Hong Kong could be China’s “testing ground” for gauging wider crypto acceptance. Thielen emphasizes Hong Kong’s unique position in attempting to lure the crypto asset management sector, which, in his words, has remained the elusive “missing piece of the puzzle.”

Time will reveal the full extent of Hong Kong’s impact on the East Asian crypto arena. But for now, it stands as a promising prologue to what could be a new chapter in the region’s digital currency narrative.