“Layer 2” cryptocurrencies, which are native to projects built on top of “layer 1” blockchains like Bitcoin and Ethereum, have recently found a new lease of life. This resurgence comes after a year of stagnation, driven by the anticipation of easing U.S. borrowing costs and the prospect of a U.S. spot bitcoin exchange-traded fund, lifting crypto prices significantly since the summer.

Market data reveals that tokens associated with layer 2 projects, aimed at speeding up transactions and cutting costs, have a combined market cap of about $14.3 billion, approximately a tenth of the total crypto market. Matic, the largest layer 2 token with a market cap of $6.90 billion, has seen a 20% increase over the past 30 days. It is used on Polygon, a platform designed to reduce congestion on the Ethereum network.

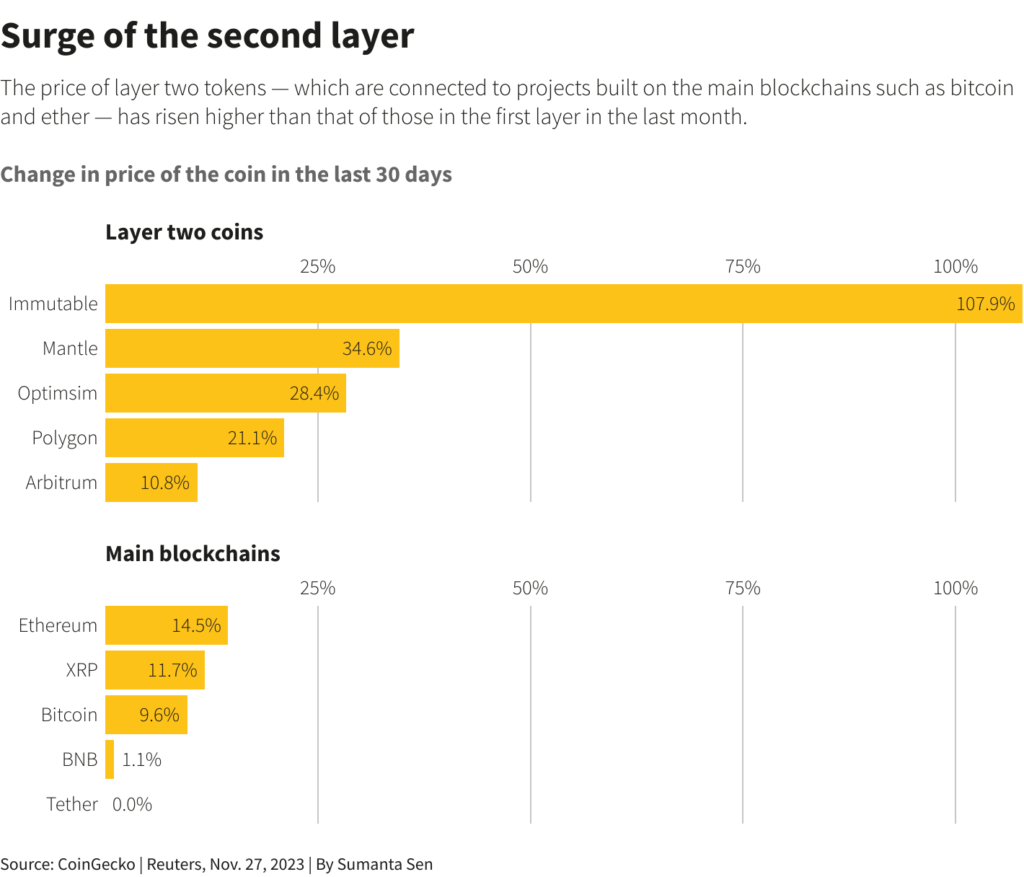

The next four largest coins – Immutable, Mantle, Arbitrum, and Optimism – have seen their values leap between 9% and 105% over the past month. However, it’s important to note that all five tokens are still down between 16% and 86% from their all-time highs achieved over the past two years.

Ether, the layer 1 token linked to the Ethereum blockchain, has also seen significant growth, leaping 13.8% in the past month. Layer 2 tokens, which have proliferated in recent years, are noted for being a risky business due to their small size and thin trading, leading to high volatility and unpredictability.

Matteo Greco, a research analyst at Fineqia International, points out the speculative nature of these tokens, with many failing to sustain long-term growth. The price performance of these tokens varies considerably, with some like Matic falling about 3% in 2023, while others like the gaming token Immutable have more than tripled in price.

Layer 2 tokens are seen as a gauge of sentiment towards the projects they are linked to, but their extreme volatility also lends them a speculative character. They are often the last to catch a bid when the broader crypto market rises and the first to sell off when sentiment is shaken.

Joshua Peck, chief investment officer at hedge fund TrueCode Capital, suggests that active trading might be the right approach for these tokens due to the market’s significant movement. The future of layer 2 tokens remains uncertain, with many analysts viewing these projects as vital for expanding the practical uses of blockchains in various sectors. However, the market is crowded, and many projects launched during the crypto boom of 2020 have since struggled.

Alyse Killeen, managing partner at venture capital firm Stillmark, expresses skepticism about the current market’s seriousness. Nevertheless, many investors believe that only projects with useful practical applications will survive in the long term, with the real test of their value coming in bear markets.