cryptocurrency and fintech groups were fined a staggering $5.8 billion in 2023, surpassing penalties imposed on traditional financial institutions for the first time. This development, reported by Laura Noonan and Alan Smith of the Financial Times, underscores the increasing scrutiny and regulatory pressures facing the digital finance sector.

The surge in Penalties for Crypto and Fintech The fines, which targeted lapses in customer checks, anti-money laundering controls, and other financial crime violations, saw a significant portion levied against major crypto exchange Binance. The $4.3 billion penalty against Binance alone, seen as a cautionary move by U.S. prosecutors, greatly exceeded the $835 million in fines paid by traditional financial services groups, marking the lowest level for the sector in a decade.

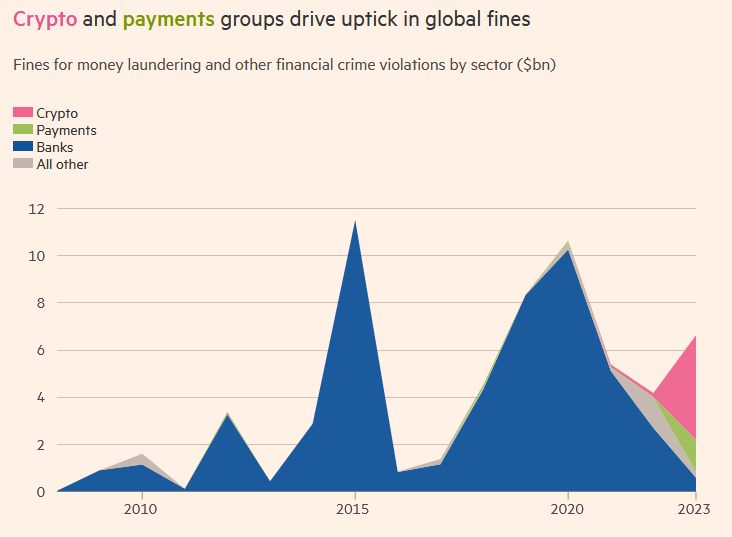

Reflecting Challenges in New Finance Sectors According to Dennis Kelleher, CEO of Washington-based advocacy group Better Markets, these figures indicate rampant malpractices in newer finance areas rather than improvements in traditional banks. The data, compiled by compliance software provider Fenergo, revealed that total fines for financial crime violations rose over 30% to $6.6 billion, still below the 2015 peak of $11.3 billion.

The increase in fines for crypto and payment providers was marked last year, with crypto firms incurring 11 fines compared to an average of less than two annually over the previous five years. Payment firms also saw a rise in penalties, with most of the fined entities being less than 20 years old. David Lewis, a former head of the Financial Action Task Force, highlighted the ongoing risks and regulatory gaps in the crypto sector, predicting more fines in the future.

Regulatory Focus and Adjustments Regulators worldwide, including the UK’s Financial Conduct Authority, have been emphasizing the need for improved controls in the payments sector. Fines against crypto and payment groups are expected to increase as new regulatory regimes are introduced. Andrew Barber, partner at law firm Pinsent Masons, noted that firms previously operating without regulatory oversight might face challenges adjusting to new standards.

Charles Kerrigan, a crypto specialist at law firm CMS, suggested that the tightening of controls in the crypto sector might lead to a decrease in financial crime. He also noted that the relatively small global market capitalization of crypto, at $1.8 trillion, limits its potential for fueling significant levels of financial crime compared to the traditional financial system.

In conclusion, the record fines imposed on cryptocurrency and fintech firms represent a pivotal moment in the financial sector’s evolution. As regulators continue to tighten their grip on these emerging markets, the crypto and fintech industries face the challenge of adapting to increasingly stringent standards, reshaping the landscape of digital finance.