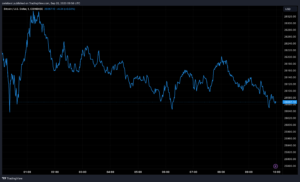

Bitcoin experienced subdued activity, with its value breaking below the $26,500 support amidst a strengthening US dollar in the foreign exchange market. This downward price action signals potential further losses below the $26,000 support in the short term.:

However, several analysts remain optimistic, forecasting a forthcoming Bitcoin bull run. Notably, a crypto analyst known as “Titan of Crypto” anticipates a significant surge in Bitcoin’s value over the next year, potentially doubling or more.

Analysts Foresee a Price Surge:

The analyst, operating under the handle @Titan of Crypto, predicts substantial gains for Bitcoin leading up to the next halving event in 2024, drawing on historical price patterns. According to him, Bitcoin’s price has consistently aligned with the 78.60% Fibonacci retracement level in the months preceding the three previous halving events in 2012, 2016, and 2020.

If history is any indicator, Bitcoin could see its price escalate from $26,130 to $48,700, with another prediction placing the next peak for Bitcoin’s current cycle at $108,000. However, it is crucial to note that past performance does not guarantee future results.

The Halving Impact

The Bitcoin halving, a process that reduces the block reward for miners by half, is historically known to induce a bullish effect on Bitcoin. Analysts, including those from equity research firm Fundstrat, have echoed similar sentiments, predicting a bullish impact on Bitcoin prices due to the next halving, scheduled for April 2024.

Another analyst, @100trillionUSD, has also foreseen a series of events leading to the next halving, including a rise in Bitcoin prices. He maintains that the 2024 halving should see Bitcoin at a price exceeding $32,000, with a subsequent bull market propelling Bitcoin above $100,000.

Market Divergence

While many analysts maintain a bullish outlook, not all share this perspective. Analyst Nicholas Merten has cautioned about a potential $440 billion decline in the overall crypto market capitalization, especially considering the implications of the Fed’s recent decisions on interest rates on the crypto market.

Conclusion

Despite the recent quietude and potential risks, the prevailing sentiment among several analysts is one of optimism, with predictions of a substantial increase in Bitcoin’s value in the coming years, particularly around the next halving event. However, the contrasting viewpoints and the inherent volatility of the crypto market necessitate cautious optimism and diligent market observation.