Digital asset investment products are on a promising upswing. The past week saw the most considerable inflows since July 2023, painting an optimistic picture for the industry, a fresh report suggests.

Highlighting this bullish trend, crypto investment products registered inflows for two weeks straight, amassing a total of $78 million. This insight was brought to light by the crypto asset management powerhouse, CoinShares, in their comprehensive analysis released on Oct. 9.

Furthermore, diving into the specifics, CoinShares pointed out a remarkable 37% surge in the volumes of crypto exchange-traded products (ETPs) in just the past week, tipping the scales at a whopping $1.1 billion. Additionally, Bitcoin’s trading volume on trusted platforms witnessed a commendable 16% uptick, as noted in the report.

One of the biggest recent market successes Solana, currently ranked as the eighth-largest cryptocurrency by market cap, has firmly positioned itself as the “altcoin to watch.” Its weekly inflows soared to heights not seen since March 2022. While Solana has enjoyed a 14% price hike over the past month, it remains about 32% below its annual peak, based on figures from CoinGecko.

However, it’s essential to strike a balanced view. Even with the broader crypto product inflow growth, not all assets shared in this enthusiasm. For instance, the U.S. Ethereum futures exchange-traded funds (ETFs) – introduced to the market on Oct. 2 – only managed to pull in around $10 million in their debut week. CoinShares characterized this as a “mild response.”

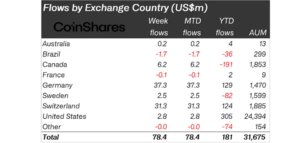

Taking a more global perspective, an interesting trend emerges. A staggering 90% of all crypto asset inflows originated from Europe. In contrast, the combined inflows from the U.S. and Canada totaled just $9 million. Among European nations, Germany and Switzerland were the driving forces, contributing $37.3 million and $31.3 million respectively. Collectively, these two nations represented a dominant 88% of the previous week’s total crypto asset inflow.

On the business front, CoinShares is strategically broadening its U.S footprint, having introduced its inaugural offerings in the nation in September 2023. The firm remains bullish on the U.S., viewing it as a pivotal player in both digital asset innovation and regulatory leadership.