The Bitcoin network is experiencing a renaissance of development opportunities thanks to the rapidly growing BRC-20 ecosystem, which is drawing attention with its rapidly increasing market capitalization. This growth signals new possibilities for Bitcoin, traditionally seen as a stable but less dynamic component of the cryptocurrency sphere.

Bitcoin has served as the foundation of the cryptocurrency market, with its protocol remaining largely unchanged to preserve its hundreds of billions in value and global trust. However, this stability has made Bitcoin seem less exciting compared to newer blockchain architectures that support a wider range of applications. The introduction of Ordinals technology has breathed new life into Bitcoin, sparking a fresh wave of innovation without altering the core code.

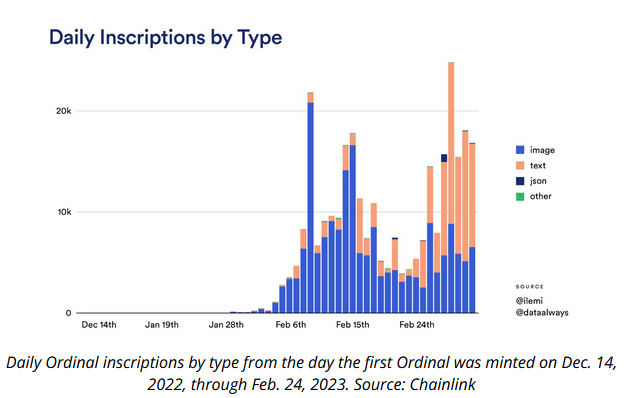

The year 2023 has seen significant developments within Bitcoin’s ecosystem. New asset types, such as Ordinals NFTs and BRC-20 tokens, have generated excitement among the community, leading to an increase in BTC miners’ earnings. These advancements have allowed for the issuance of tokens on the Bitcoin network, securing their reliability through Bitcoin’s own blockchain.

Ordinals, a protocol that operates atop the Bitcoin blockchain, enables unique identification for each sat (the smallest Bitcoin unit), which can be transacted with attached data. This concept, pioneered by Casey Rodarmor, has unlocked the potential for an array of Bitcoin-based NFTs and a virtually unlimited number of tokens to be traded on Bitcoin.

Initially, the technical complexity of minting and trading Ordinals limited their accessibility. However, the emergence of more user-friendly solutions has democratized the process, especially for the Ethereum community. While NFTs were the first application of the Ordinals protocol, it is also being used to issue fungible tokens, similar to Ethereum’s ERC-20 tokens, known as BRC-20 tokens.

The BRC-20 standard is quickly gaining traction, with new projects and Bitcoin-based tokens emerging, contributing to a nascent tokenized ecosystem centered on Bitcoin and Ordinals. Some BRC-20 tokens have captured the imagination of the market, finding their way to major exchanges and heralding the BRC-20 movement.

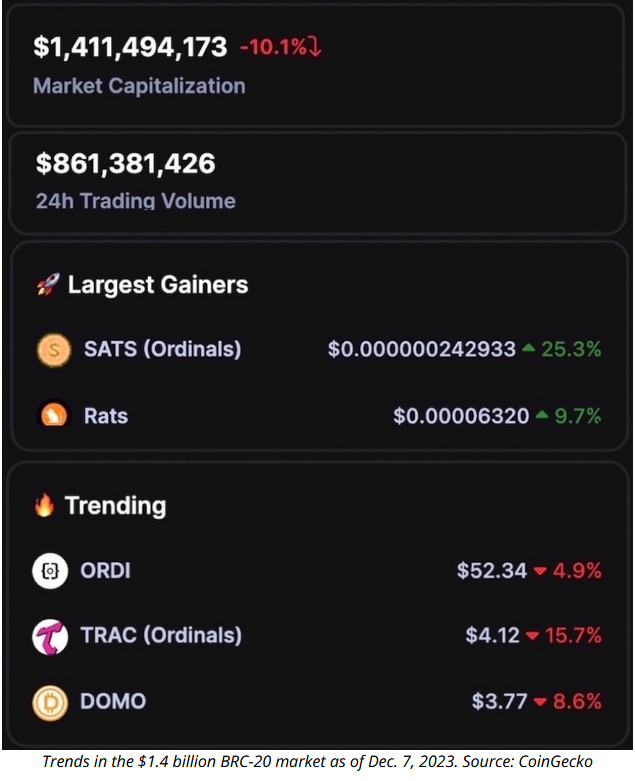

The community around Ordinals and Bitcoin is thriving, with a focus on entertainment through gaming, collecting, and socializing. One standout is the $SATS token, a memecoin that is also a BRC-20 token, designed to make Bitcoin engaging and educational. The total supply of $SATS mirrors the Bitcoin supply, creating a sat for every satoshi in existence.

The market capitalization of all BRC-20 tokens has exceeded $1.4 billion, indicating a significant potential for further growth. This expansion has been made possible by the Taproot upgrade, implemented in November 2021, which allowed for the addition of data to Bitcoin block space, facilitating token minting.

Despite some Bitcoin enthusiasts’ concerns over the new tokens occupying block space and potentially raising transaction fees, the BRC-20 standard is laying the groundwork for a more diverse ecosystem on the Bitcoin network. The ongoing development of infrastructure to bridge Bitcoin tokenization with EVM chains, such as MultiBit’s two-way bridge for BRC-20 and ERC-20 tokens, is strengthening this new frontier.

Looking ahead, the BRC-20 standard positions Bitcoin similarly to where Ethereum was in 2017, brimming with untapped potential. With key developments in the pipeline, the future of BRC-20 tokens could mirror the explosive growth of ERC-20 tokens and ICOs, presenting lucrative opportunities for early adopters.

For a segment of the crypto community seeking a break from the perceived stagnation of Ethereum and a middle ground away from Bitcoin maximalism, Ordinals and BRC-20 tokens have reignited the innovative and experimental spirit of the Bitcoin network, making the crypto space exciting once more.