In a recent rally, Bitcoin has soared to an impressive $35,000, marking its highest point since the turbulence of 2022. This remarkable surge has been driven by the fervent optimism surrounding the potential approval of exchange-traded funds (ETFs).

Optimism Peaks with Possible ETF Approval

The buzz in the financial world intensified when a potential ETF ticker was momentarily visible on the DTCC. This development was highlighted by Eric Balchunas, a noted analyst at Bloomberg Intelligence, sparking widespread speculation and interest. Though the listing has since been removed, this fleeting glimpse was enough to fuel the speculative fire.

A Stellar Recovery

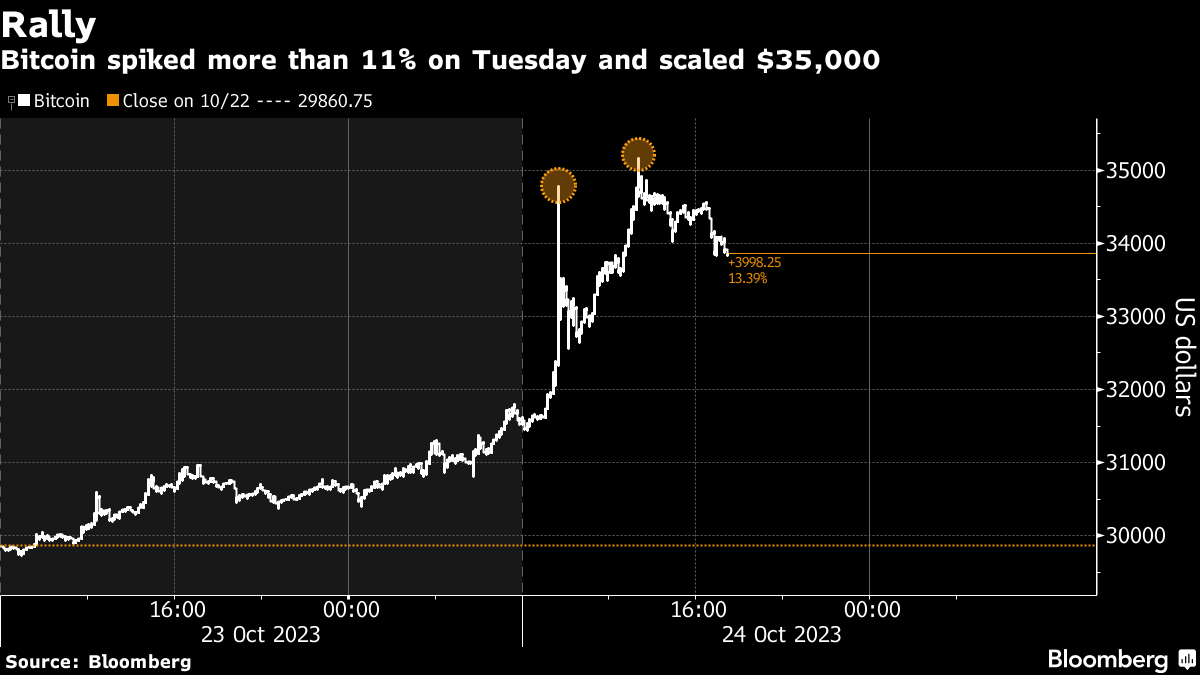

Bitcoin, the most dominant digital asset, experienced an 11.5% surge, reaching beyond the $35,000 mark. While it did pare back some of its gains, trading at $33,517 as of 11:43 a.m. in New York on Tuesday, it has successfully doubled in value since the digital asset rout in 2022.

The Role of ETFs in Wider Adoption

The impending approval of the United States’ first spot Bitcoin ETFs has been a significant catalyst in this rally. Heavyweights in asset management, such as BlackRock Inc. and Fidelity Investments, are at the forefront, racing to offer these innovative products. Advocates for digital assets argue that the introduction of ETFs will play a crucial role in broadening the adoption of cryptocurrency.

A Victory in the Courts

Grayscale Investments LLC has secured a noteworthy victory in the courts, with a U.S. federal appeals court officially endorsing its bid to establish a spot Bitcoin ETF, despite initial objections from the U.S. Securities and Exchange Commission (SEC). Historically, the SEC has been cautious, citing concerns of fraud and market manipulation. However, this recent court ruling, coupled with a flurry of applications from renowned investment firms, has ignited speculation that the SEC may be on the verge of a change in stance.

Bitcoin’s Rally and The Market’s Response

Bitcoin’s latest rally was not an isolated incident; it surged by 10% at the start of the previous week, propelled by the anticipation surrounding ETFs. However, an inaccurate report claiming that BlackRock had obtained approval for a fund launch momentarily caused a stir, and the rally subsided once the error was corrected.

Ether, Bitcoin’s closest rival, also experienced a boost, climbing 8.5% and momentarily exceeding $1,800. Other smaller tokens, including BNB, XRP, and the popular Dogecoin, saw initial sharp increases before stabilizing.

According to data from Coinglass, approximately $387 million worth of crypto trading positions, predominantly from speculators betting on a price drop, were liquidated in the last 24 hours.

The Future of Bitcoin and Crypto

Despite its recent success, Bitcoin still falls short of its 2021 peak of almost $69,000. The token has faced challenges due to rising interest rates, which have dampened demand for riskier assets. Recent times have seen a decrease in its correlations with other assets like stocks, bonds, and gold, leading to speculations about the level of engagement from mainstream investors.

“Liquidity is somewhat better than before,” observed Justin d’Anethan, Head of Business Development in the Asia Pacific at Keyrock, a crypto market maker. “Prices have now recuperated, bringing with it a certain amount of liquidity — still nothing compared to the euphoria of 2020-2021, though.”

As the crypto world eagerly anticipates the SEC’s final stance on spot Bitcoin ETFs, the market remains in a state of high anticipation, curious to see if this innovative financial product will indeed serve as a catalyst for broader adoption and integration into the mainstream investment world.