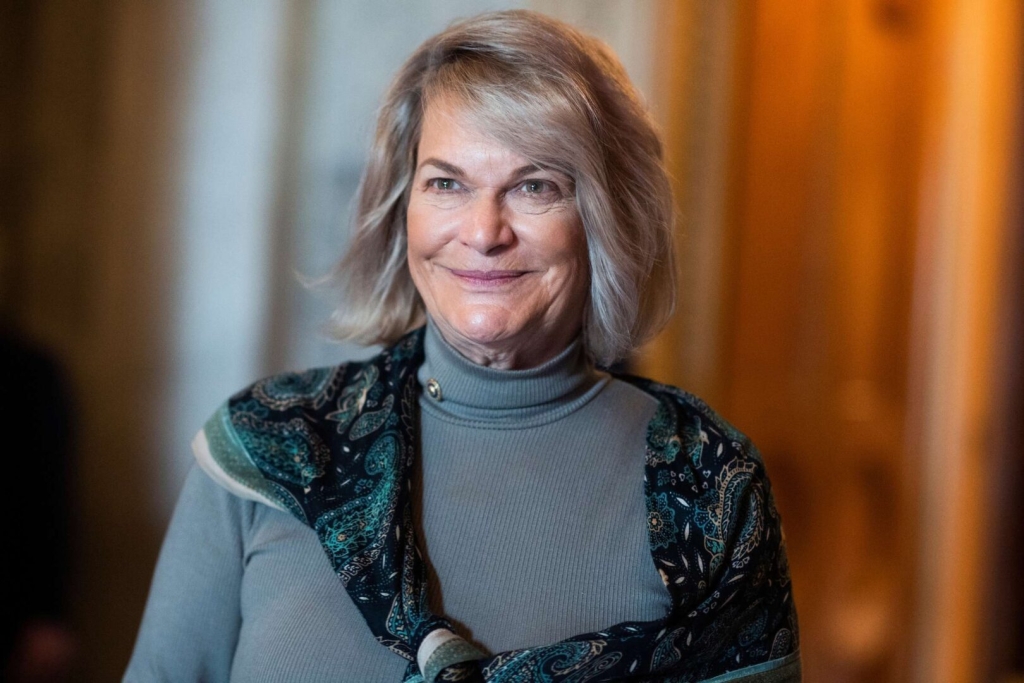

The United States is taking a major step toward financial innovation, as Sen. Cynthia Lummis (R-Wyo.) has reintroduced the Boosting Innovation, Technology, and Competitiveness through Optimized Investment Nationwide (BITCOIN) Act in the U.S. Senate.

Co-sponsor Sen. Roger Marshall (R-Kan.) emphasized the importance of embracing change to maintain America’s financial dominance:

“America must adapt to stay the world’s finance superpower.”

BITCOIN Act Proposes U.S. Strategic Bitcoin Reserve

The legislation seeks to establish a Strategic Bitcoin Reserve, positioning Bitcoin as a national asset akin to gold. The reserve would serve as a hedge against economic instability, diversify U.S. holdings, and bolster financial security.

“For the first time, the U.S. government is formally committing to a long-term Bitcoin investment through executive and legislative action.”

A Move Toward Institutional Bitcoin Adoption

The BITCOIN Act builds upon President Trump’s executive order, signed on March 6, 2025, which laid the foundation for a national Bitcoin strategy.

By reintroducing the BITCOIN Act, Congress is working to codify Bitcoin’s role as a strategic asset, ensuring that the U.S. remains at the forefront of digital asset innovation and adoption.

With the U.S. government formally recognizing Bitcoin’s long-term value, this move represents a historic shift in how nations approach digital assets as part of their financial infrastructure.