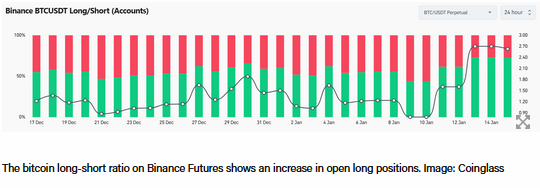

The long-short ratio for Bitcoin on Binance Futures has reached a multi-month high, reflecting investor optimism in the cryptocurrency market. This ratio serves as a vital indicator of market sentiment, with a higher long-short ratio indicating a more bullish outlook for Bitcoin’s future price performance.

Over the past 24 hours, the long-short ratio has experienced a notable uptick, soaring to 2.86. This significant increase comes despite Bitcoin’s recent retracement, following the approval of multiple spot Bitcoin exchange-traded funds (ETFs). Notably, the current reading is considerably high, especially when compared to a balanced market where an equal number of traders hold long and short positions, resulting in a ratio of 1.

To provide context, just last week, before the approval of multiple spot bitcoin ETFs, the long-short ratio stood at a modest 0.86. However, after the ETF approvals, traders have increasingly leaned towards long positions, anticipating a positive trajectory in Bitcoin’s value.

Additionally, data from Coinglass, a crypto derivatives analysis platform, supports these findings, reporting a long-short ratio of 2.63 for bitcoin positions on Binance Futures. This corroborates the prevailing bullish sentiment among traders.

The notable increase in the long-short ratio underscores the growing confidence in Bitcoin’s future performance. While recent market developments, such as the approval of spot bitcoin ETFs, have boosted this optimism, the extent of their impact on Bitcoin’s price in the coming weeks remains uncertain.