The cryptocurrency market is witnessing a remarkable resurgence, particularly fueled by the Asian market, as the year draws to a close. Bitcoin, the flagship digital currency, has seen a significant uptick, with a 16% rise in December, taking its annual gain to an impressive 160%. The current price of around $44,000 harks back to levels not seen for 20 months, casting a shadow over the tumultuous times of crashes and controversies that the crypto world has experienced.

As the industry transitions, figures like Sam Bankman-Fried and Changpeng Zhao, once at the pinnacle of the crypto hierarchy, are now regarded as part of an old era, their reputations tarnished by associations with previous wrongdoings.

Within the sector, a renewed sense of confidence is palpable. Investment opportunities are burgeoning, from private credit funds specializing in Bitcoin to crypto funds that are trading for many times their intrinsic value. This buoyancy is further bolstered by the anticipation of a U.S.-based spot Bitcoin exchange-traded fund, which many expect to debut soon.

A critical, though less discussed, aspect of this rally is the role of Asia. In contrast to the stringent measures taken by the United States, Asian countries have not been as aggressive in their regulatory crackdowns. This difference is exemplified by the case of Do Kwon, the entrepreneur implicated in the TerraUSD collapse, who is sought by both South Korea and the U.S. for various charges.

The regulatory environment in countries like Singapore, Japan, and South Korea is perceived to be more welcoming to cryptocurrencies, according to Ram Ahluwalia, CEO of Lumida Wealth Management. He notes that these markets are more speculative, and certain crypto subsectors, such as gaming, enjoy considerable popularity.

The Korean won has now overtaken the U.S. dollar as the primary fiat currency for crypto trading, a shift underscored by the won’s 41% market share, up from 24% in September. Concurrently, the U.S. dollar’s dominance has diminished slightly.

The Asian trading hours have become crucial, as indicated by Bitcoin’s breakthroughs during these times, highlighting the significance of retail volumes from regions like South Korea, as pointed out by Michael Safai of Dexterity Capital. Retail investment, he adds, is the lifeblood of the crypto markets.

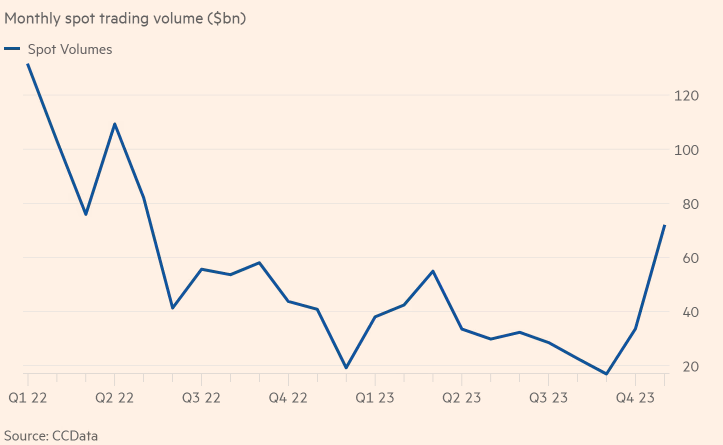

This resurgence is also reflected in the trading volumes of Asia’s popular exchanges, OKX and Bybit, which have seen considerable increases in both spot and derivatives markets. These gains are particularly noteworthy as they have come at the expense of Binance, which has seen its market share decline.

The enthusiasm for cryptocurrencies in Asia demonstrates that the speculative and retail drive behind digital assets remains robust. Moreover, the crypto embrace by Wall Street is not just a boon for institutional investors but also helps to rekindle retail interest globally, creating a positive feedback loop within the industry.