Jamie Dimon, CEO of JP Morgan, reaffirmed his critical view of Bitcoin, labelling it a “fraud” and likening it to a “public decentralized Ponzi scheme.” Despite his harsh words for Bitcoin, Dimon acknowledged the potential value of blockchain technology and smart contracts, highlighting their practical applications beyond the cryptocurrency.

During the discussion with Bloomberg’s Emily Chang, Dimon was categorical about his scepticism towards Bitcoin as a viable currency. “If you mean crypto like Bitcoin, I’ve always said it’s a fraud,” he stated, emphasizing his doubt about its legitimacy and utility.

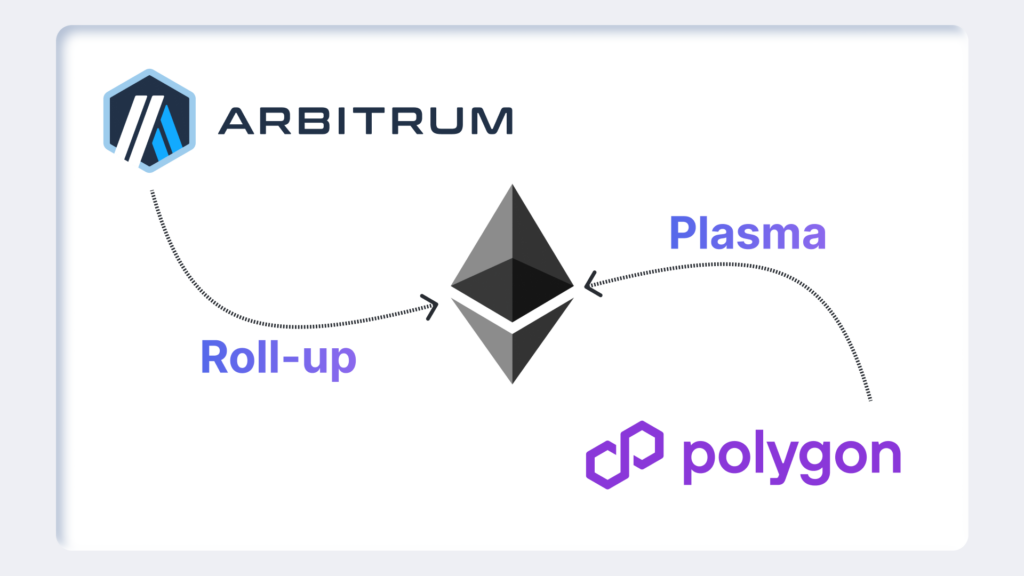

However, Dimon differentiated his views on cryptocurrencies by expressing a conditional endorsement of blockchain technology. “If it’s a crypto coin that can do something like a smart contract that has value, there will be smart contracts and blockchain works,” he explained. This suggests a recognition of the underlying technology’s benefits, even if he remains a vocal critic of Bitcoin itself.

The crypto community responded to Dimon’s comments with characteristic humour. Platforms like Wallstreetbets and individuals such as Bitcoin Munger used social media to dismiss Dimon’s critiques as fear, uncertainty, and doubt (FUD), even suggesting that such statements could be indirect prompts to buy more Bitcoin.

Despite his longstanding criticism, which includes citing Bitcoin’s association with illicit activities such as sex trafficking and terrorism financing, Dimon’s views contrast sharply with the actions of JP Morgan. The financial giant is actively involved as an “authorized participant” in spot Bitcoin ETFs—a move approved by the U.S. Securities and Exchange Commission and involving major players like BlackRock, Invesco/Galaxy Digital, and Fidelity.

This involvement highlights a complex relationship between Dimon’s public statements and JP Morgan’s strategic investment decisions, reflecting a broader institutional ambivalence towards cryptocurrency. Even as Dimon vows to no longer discuss Bitcoin in media outlets like CNBC, JP Morgan analysts have been weighing the cryptocurrency’s market potential, with predictions that Ethereum might outperform Bitcoin in 2024.

While Jamie Dimon’s latest remarks echo his previous criticisms of Bitcoin, they also underscore a nuanced stance on the broader landscape of digital assets, distinguishing between the cryptocurrency and the technological innovation it spurred. This ongoing debate within financial circles illustrates the tension between traditional banking perspectives and the evolving digital economy.