Ethena Labs has stirred the crypto waters with the launch of its governance token, $ENA, alongside the expansion of its synthetic dollar token, USDe. This move has not only attracted accolades from industry heavyweights like Arthur Hayes but also placed Ethena at the centre of a whirlwind of scrutiny and scepticism.

The path to $ENA’s debut is fraught with controversy, from misleading press releases to comparisons with the catastrophic collapse of the Terra ecosystem. Yet, despite these challenges, Ethena has emerged as a significant player in the cryptocurrency landscape, with its market capitalization soaring to $1.2 billion, making it the 80th most valuable cryptocurrency according to Coingecko.

At the heart of Ethena’s innovation is the ambition to redefine decentralized finance (DeFi) by blending decentralization, accessibility, and security. By distributing 5% of the total $ENA supply to USDe and sUSDe holders, Ethena aims to bolster its community engagement and reinforce the token’s utility within its ecosystem.

However, the protocol’s approach, particularly its reliance on crypto assets rather than traditional fiat reserves for backing its stablecoin, USDe, has been met with a mix of interest and apprehension.

The Ethena protocol leverages Ethereum and staked Ethereum as collateral for USDe, aiming to ensure stability through a sophisticated delta hedging strategy. This method involves creating a safety net that adjusts to Ethereum’s price fluctuations, thus maintaining USDe’s peg to the US dollar. Despite the ingenuity behind this approach, it introduces a complex layer of risk, underscoring the importance of the DYOR (Do Your Own Research) ethos for potential investors.

Ethena’s governance structure, underpinned by $ENA, is designed to empower holders with decision-making authority over the protocol’s future. This democratization of control mirrors the shareholder dynamics in traditional companies, offering a glimpse into the evolving landscape of token governance in the DeFi sector.

However, the protocol’s operational intricacies, especially its Off-Exchange Settlement (OES) mechanism, present a formidable challenge. By managing assets off-exchange, Ethena aims to mitigate hacking risks and exchange failures. Yet, this system demands meticulous coordination and management, balancing centralized efficiency with decentralized transparency.

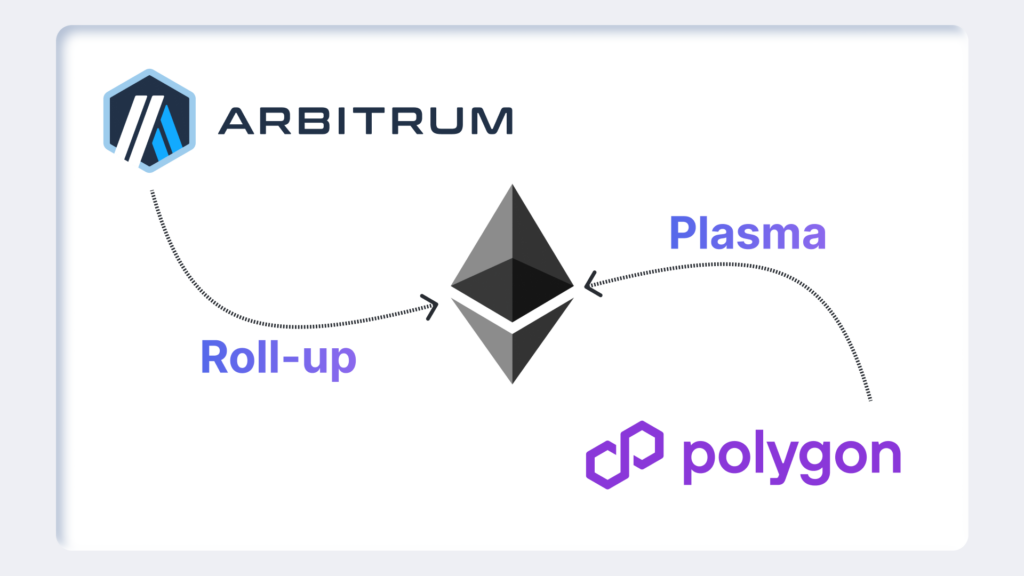

As Ethena navigates the complexities of liquidity management and strategic adjustments, its plan to diversify collateral types and broaden its blockchain ecosystem presence signifies a bold, albeit convoluted, strategy for scaling and innovation.

The launch of $ENA and the expansion of USDe by Ethena Labs marks a significant yet controversial milestone in the DeFi space. With a backdrop of legal misunderstandings and the specter of past DeFi collapses, Ethena’s journey is a testament to the volatile yet vibrant nature of cryptocurrency innovation.

As the protocol strides into the future, the crypto community watches closely, balancing optimism with caution, eager to see whether Ethena can navigate its complex blueprint towards a stable and prosperous horizon.