A recent addition to the open-source directory for Uniswap V4 hooks has ignited a heated debate within the cryptocurrency community. This new hook introduces the capability for Know Your Customer (KYC) checks before users can engage in trading on a liquidity pool.

Critics of this hook argue that it opens the door for decentralized finance (DeFi) protocols to become whitelisted by regulatory authorities. One user, expressing concern on a social platform, pointed out the potential slippery slope:

“As I explained in all my posts for the past year: It starts with ‘kyc option’ for LPs. And then eventually it moves into a ‘regulator whitelist approved’ database hosted offchain. And then non-kyc gets labeled as illegal terrorist money laundering. Stop simping for soyboys.”

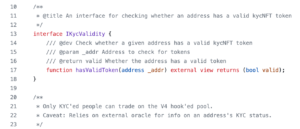

Essentially, a hook in this context is a tool that allows developers to customize a code without altering the primary structure of the program. In the case of Uniswap V4, this particular hook facilitates KYC verification within the DeFi protocol.

KYC, or Know Your Customer, procedures are commonly employed by financial institutions to verify customer identities and assess potential risks. A primary objective of KYC is to identify and prevent money laundering and terrorist financing activities.

The KYC hook was introduced by a community developer on Uniswap V4’s directory as an optional feature. KYC verification is carried out through a nonfungible token (NFT). According to another user, the hook is tailored for liquidity providers and may prove beneficial for projects that need to comply with regulatory requirements in specific jurisdictions:

“It seems like you don’t understand how this works. Firstly, it’s specific to liquidity providers. Some projects may want to operate within the legal boundaries of certain jurisdictions. Secondly, hooks can be developed by community developers. You’re criticizing something that has contributed more than anyone else to ‘real DeFi’.”

Governments worldwide are increasingly scrutinizing DeFi protocols and transactions. Notably, the G20, which consists of the world’s largest economies, recently embraced a crypto regulatory roadmap proposed by the International Monetary Fund (IMF) and the Financial Stability Board (FSB), which entails stricter regulations for cryptocurrencies.

Uniswap V4 is set to introduce customizable hooks, with an expected release date in early 2024. Access to these features will be limited to entities approved by the governance structure.